By Xu Ying

In a world marked by geopolitical volatility, sluggish global growth and a shifting technological landscape, one trend defies conventional wisdom: Global corporations are not retreating from China. Far from it! They are accelerating their investments, reshoring production lines, embedding research and development in local innovation clusters and pouring billions into next-generation green infrastructure. The result is a structural transformation in global industrial strategy – one where China is no longer viewed merely as the world's factory, but as a critical hub for sustainable growth and high-value technological breakthroughs.

This trend is not accidental. It is underpinned by a recognition among multinational corporations that long-term resilience, profitability and competitiveness increasingly depend on three factors: proximity to industrial ecosystems, leadership in green regulation and standards and access to vibrant, high-speed innovation networks. China today offers all three in a way that no other economy can match, making its role in global value chains more indispensable than ever.

A new wave of strategic reshoring

The latest wave of reinvestment in China tells a compelling story. Industrial giants such as ExxonMobil, Schneider Electric and Henkel have committed billions of dollars in fresh capital to expand their footprints within China's dynamic manufacturing clusters. ExxonMobil has launched a $10 billion ethylene project in Huizhou to capture Asia's surging demand for battery separator materials, while Schneider's carbon-neutral "lighthouse factories" in Wuxi now set global benchmarks for energy efficiency and emission reductions.

What unites these investments is not cost arbitrage – China is no longer a low-cost manufacturing destination – but operational depth and speed-to-market advantages. Supply chain resilience in a turbulent world is a powerful incentive. By clustering suppliers, customers, logistics hubs and research and development (R&D) labs within hours of one another, firms can cut lead times, reduce risk exposure from geopolitical shocks and gain a decisive competitive edge.

Beyond supply chain considerations, the rise of China's green regulatory framework is transforming industrial strategies worldwide. China is no longer just a participant in the global transition to low-carbon economies. It is shaping the rules of the game. Standards such as "China VII," anticipated for 2027, push ultra-low emissions thresholds that surpass many European equivalents.

Consider Schneider Electric's Wuxi "lighthouse factory." Through AI-driven energy optimization and digital twin technologies, it has reduced Scope 1 and 2 emissions by 90 percent. Such examples not only demonstrate China's ability to enforce ambitious environmental benchmarks but also set a template that other emerging markets, from Vietnam to Brazil, are starting to adopt. By investing early in China's green transition, corporations gain a first-mover advantage that positions them to meet rising environmental expectations worldwide.

This is no longer a story about regulatory arbitrage for lax standards. It is the opposite: Global firms are leveraging China's tough environmental framework as a springboard for global competitiveness, proving that sustainability and profitability can go hand in hand.

Equally transformative is the deep localization of research and development. Innovation cycles are now anchored where ideas, suppliers and customers converge, and few ecosystems can match China's dynamism. In May, the German multinational company, Henkel launched its Adhesive Technologies Application Engineering Center in Shanghai, aiming to accelerate "the transformation of innovations into industrial applications through the testing of localized applications and process scale-up."

Companies that build deep roots in China's innovation landscape develop products faster, adapt them more effectively to both domestic and international markets and capture emerging opportunities ahead of competitors. The next generation of energy storage systems, advanced adhesives for integrated die-casting and ultra-clean lubricants for electric drivetrains are increasingly born from this local-global fusion.

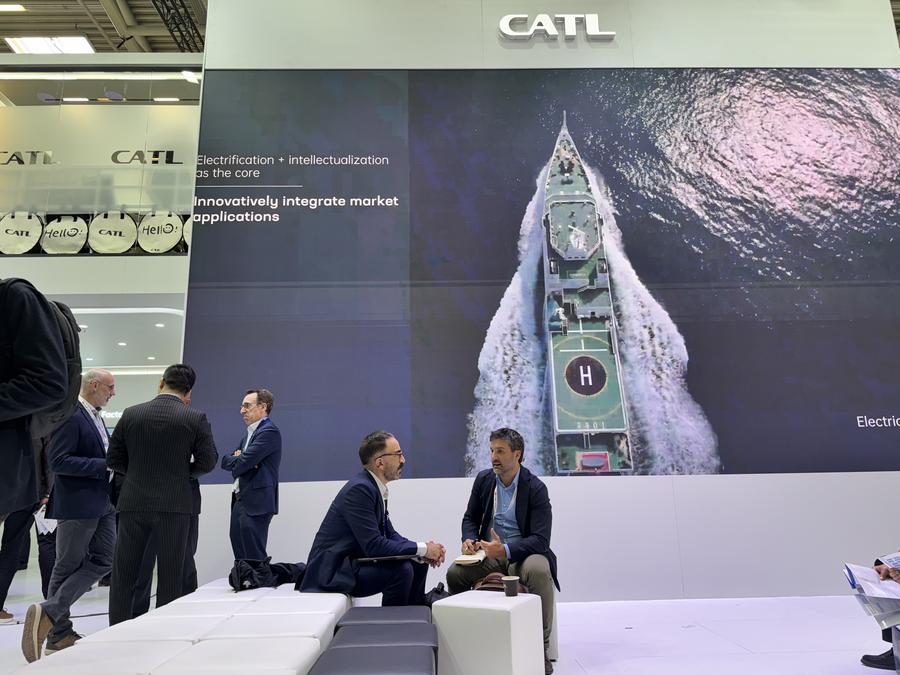

People visit the booth of Contemporary Amperex Technology Co., Ltd. (CATL) during the 2025 Intersolar Europe exhibition in Munich, Germany, May 7, 2025. [Photo/Xinhua]

China as the new global anchor

As global corporations face the "impossible trinity" of growth, risk and sustainability, China offers a rare convergence of solutions. Reinvestment liquidity, stemming from high local profits, allows capital to be recycled into advanced facilities and green co-development projects. Regulatory leadership grants early access to future environmental norms, giving first movers a global competitive edge. Deep integration with local innovation networks accelerates product breakthroughs that shape emerging industries.

This is not a return to old globalization patterns, driven by cost arbitrage and export-oriented assembly lines. It is the blueprint for new globalization: regionally embedded, sustainability-led and technologically networked. The 2025 wave of reshoring is thus not a defensive response to Western "de-coupling" or "de-risking" narratives. It is a proactive recalibration by industrial leaders who understand where future growth and global rule-setting power will reside.

A decade of opportunity ahead

Looking ahead, China's role in global value chains will evolve even further. The next decade will not be defined by sheer scale of production but by standard-setting, innovation leadership and green industrial exports. Henkel's R&D collaborations in Shanghai are feeding global EV supply chains. ExxonMobil's Huizhou site, through green technology, cutting greenhouse gases by 35 percent, demonstrates how sustainable processes piloted in China can be deployed worldwide.

In this sense, the current investment wave is more than a business trend, but a bet on China as a strategic control point for 21st-century industrial leadership. Global firms are choosing not only to manufacture in China but increasingly to invent, decarbonize and lead from China, shaping the technologies and standards that will define the next phase of globalization.

For corporate decision-makers and policymakers alike, the message is clear: The path to resilient, sustainable and globally competitive industry runs through China's innovation and green transition nexus. As the world seeks to reconcile growth with environmental responsibility and technological sovereignty, China is emerging as a partner and a platform for solving these challenges at scale.

Xu Ying is a Beijing-based international affairs commentator for CGTN.

中文

中文