This is an editorial from China Daily.

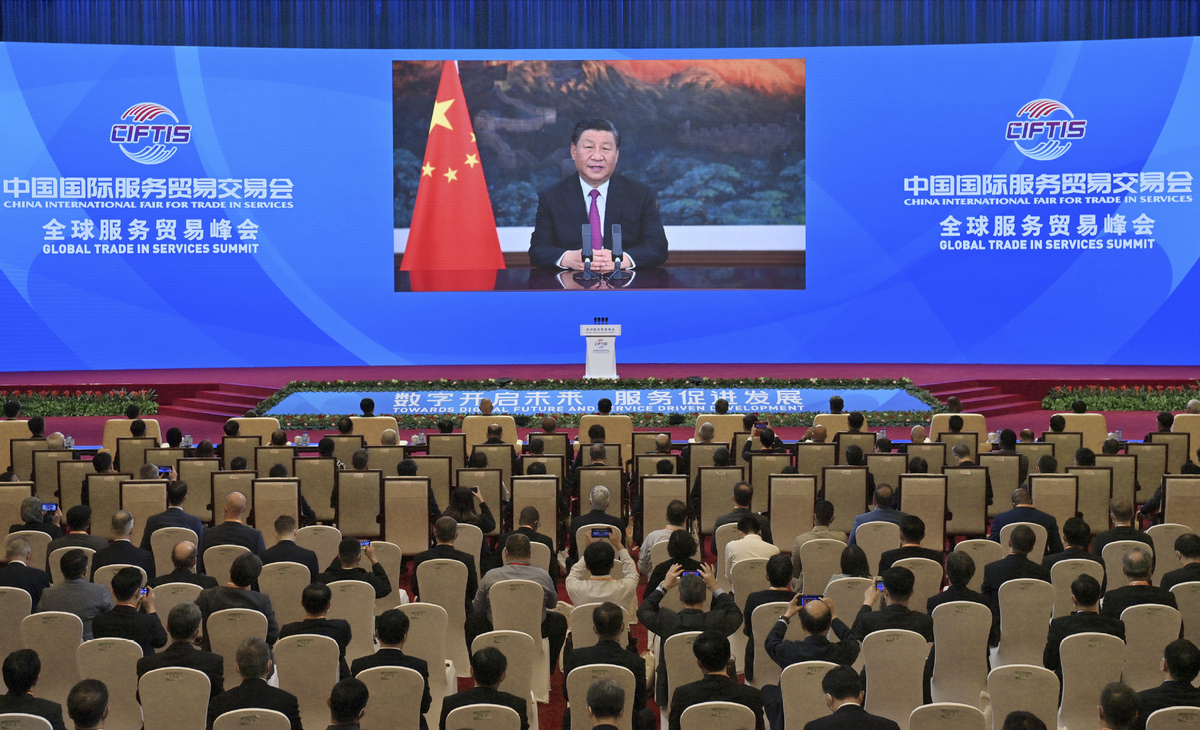

President Xi Jinping addresses via video link on Thursday the Global Trade in Services Summit of the 2021 China International Fair for Trade in Services, which is being held in Beijing from Thursday to Tuesday. [Photo by Yue Yuewei/Xinhua]

In his remarks via video links at the Global Trade in Services Summit on Thursday as part of this year's China International Fair for Trade in Services, President Xi Jinping announced that a Beijing Stock Exchange will be set up. This is intended to be the primary platform to serve the leading innovation-oriented small and medium-sized enterprises.

The decision to set up a Beijing Stock Exchange caught widespread attention as it will become the main financing provider for innovation-driven SMEs.

The move is the latest deepening reform of the National Equities Exchange and Quotations, known as the New Third Board — which comprises the Shenzhen Stock Exchange as the growth enterprise board and the Shanghai Stock Exchange as the science and technology innovation board.

The reforms and development in this field over recent years have laid a solid foundation for the Beijing Stock Exchange, which will channel funds to a selection of the most capable firms traded on the New Third Board, to promote the development of innovation-driven SMEs.

Once the Beijing Stock Exchange is set up and running, the reform of the New Third Board will embark on a new journey, according to the China Securities Regulatory Commission. Intended to be tailored for select innovation-driven enterprises, it will be a financing channel for companies at an earlier development stage than those listed in Shanghai and Shenzhen. The Beijing Stock Exchange will be mainly based on the innovation-driven SMEs selected from the New Third Board, implement the New Third Board's institutions, and pilot the registration system in securities issuance.

That said, the Beijing Stock Exchange will be a part of the New Third Board, or an upgraded version of the New Third Board to be precise.

The planned stock exchange will definitely improve the New Third Board's capacity to serve these enterprises, which in turn will help stimulate market vitality.

As such, after the Beijing Stock Exchange is founded, the three stock exchanges in Beijing, Shanghai and Shenzhen will form a three-pillar framework for the country's capital market, and with their differentiated focuses, they can meet the diverse demands of different kinds of enterprises.

With President Xi also announcing in his speech a series of reforms to further open up and boost the trade in services, the deepening reform of the capital market represents part of the combination blow the country is delivering to tackle the complicated challenges it faces in economic, financial and trade sectors.

To find the best remedies for these challenges, the country has been progressing from the easiest to the hardest, and adjusting the measures to suit local conditions. This has been and remains the underlying logic behind its reforms.

The process of refining China's capital market also follows that logic, with the founding of the new stock exchange aimed at meeting the challenges of the current stage and taking another stride forward.

中文

中文